With national debt becoming an even more hotly contested topic during the GOP primaries and upcoming elections, it’s important to delve into the facts of this economic phenomenon.

What are the levels of US national debt?

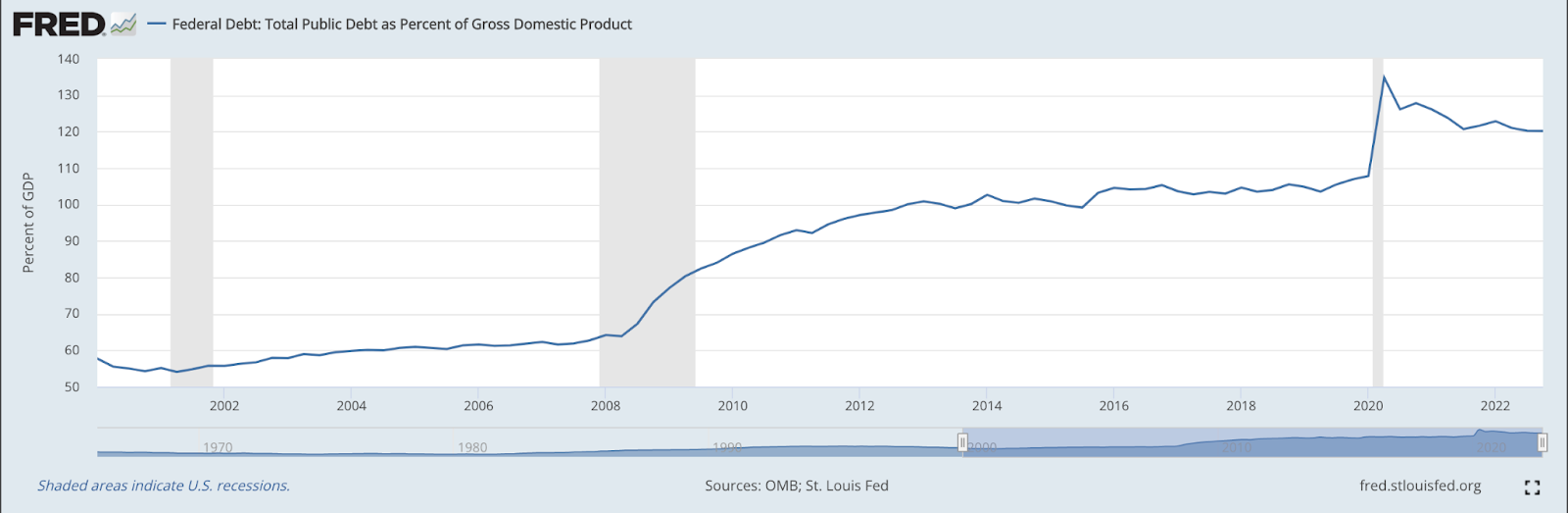

The U.S. national debt reached the debt ceiling of $31.38 trillion in January 2023, and policy officials once again had to grapple with the consequences of either defaulting or raising the debt ceiling– an issue that seems to now occur far more frequently than it once did. Examining the Federal Reserve’s economic data on total public debt as a percent of GDP between the years 2000 and 2022, it is evident that there is an upward trend of increasing debt, which over time has become increasingly more severe. During this period, the lowest level of national debt occurred in Q2 of 2001, at which point debt was only 54%. During the early years of the 2000s, the national debt was very steady, nearly flat, riding the line of around 60% until Q2 of 2008 at which point debt drastically increased until the year 2012. In 2012 debt slightly flattened off and fluctuated near 100% for the next several years. However, in Q1 of 2020, there was a dramatic spike in debt. Speeding to 135% by Q2 of 2020, debt was at its highest. From this peak, debt slightly decreased by Q3 of 2020 to 126% and appears to be continuing slowly reducing. While the situation may seem dire, many economists believe that some level of debt is necessary for the economy. However, a point of concession arises when asking at which point healthy debt becomes unhealthy.

Types of debt

There are two kinds of national debt: intragovernmental and public.

Intragovernmental debt refers to debt that the federal government owes to other government departments. One way this type of debt is caused is because some government agencies take in more revenue from taxes than they need. With their excess revenue, agencies then invest in U.S. Treasury securities. By buying treasury securities, the Treasury will then owe an intergovernmental debt to other federal agencies. Agencies like the Social Security Administration buy Treasury securities with their excess revenue because treasury securities are viewed as a reliable investment that will safely preserve the funds collected by tax dollars (because a bond will not “lose value” over time with inflation, unlike money).

Public debt, on the other hand, is the debt the government owes individuals or entities not part of the U.S. government. The majority of public debt is held by individual investors, institutions, and foreign governments.

The makeup of intergovernmental debt and public debt as factors of the overall national debt in 2023, is 22% and 78%, respectively. Evidently, intragovernmental debt is not nearly as significant of a contributor to national debt as public debt is. Additionally, intragovernmental debt has not increased by quite as much. This is primarily due to the fact that intragovernmental debt is composed primarily of debt owed on agencies’ excess revenue invested with the Treasury. Additionally, an agency’s revenue will not drastically change if taxes are not changed. The government agency that is the largest investor in Treasury securities (the biggest buyer of treasury securities and therefore “causer” of intergovernmental debt) is the Social Security Administration. Foreign governments, most notably China, investing in the U.S. are the largest contributors to public debt. Similarly, the Federal Government is now responsible for paying foreign governments back. When questioning who pays for the national debt, the answer is the Federal government. This is because debt occurs through the purchase of treasury securities which the Federal Government is responsible for buying back the securities sold. The same logic applies to public debt.

Photo by Josh Appel on Unsplash

Photo by Josh Appel on Unsplash

Is national debt “bad”?

In recognizing how national debt is created, it becomes clear that debt is not necessarily a “bad” thing. In fact, specifically when thinking about intergovernmental debt, it can occur because government agencies are generating excess revenue. Likewise, public debt can occur because our economy is strong causing increased consumer confidence, which then motivates investors and foreign governments to invest in the American economy. Moreover, government spending funds many important programs like Medicare, the military, highway maintenance, construction, social security, and education. The federal debt allows the government to pay for all these programs without having to wait for enough money, highlighting why federal debt can be necessary.

Even still, some economists are compelled to question if there is ever a point when debt becomes too large. Although an exact percentage point has not been agreed upon by economists, there are several indicators in the economy that can hint at the debt being too large. Higher interest rates are one such key indicator. If interest rates increase, the sums of money the federal government has to pay back become greater. Another indication of the U.S. debt becoming too large is if taxes rise (or are higher than normal). This is because the federal government may be trying to use the funds from taxes to pay off debt.

To prevent the potential repercussions of higher interest rates or taxes, governments have different means of monitoring their debt. The two primary ways are an incurring debt model and a balanced budget model. The U.S. follows the model of incurring debt. In essence, incurring debt is a model that allows countries to take on debt whereas balancing the budget is a regulated budget in which there is no budget surplus or deficit. An advantage of incurring debt is that the U.S has the ability to purchase goods and increase spending for programs whenever it is needed without having to wait to pay the old debt back. A disadvantage to this model is that it operates with interest rates. This means that the amount that the government must pay back is more than the amount initially borrowed. Therefore, when considering how the incurring debt model can impact fiscal policy, it is relevant to note that it can potentially cause the government to raise taxes, which can have negative consequences for citizens. Private investment could also decrease through the incurring debt model because, with increased taxes, individuals will have less money to spend. Moreover, an additional consequence of the incurring debt model could be that income distribution becomes even more uneven. Inversely a balanced budget model can be advantageous for a government because it prevents the government from spending too much. The government will have to prioritize paying back the debt that they currently have. However, a significant disadvantage of the balancing budget model is that it can potentially prolong a recession as the government will not be able to help by giving excess money.

Photo by Jorge Alcala on Unsplash

Photo by Jorge Alcala on Unsplash

Current national debt - in context

When specifically considering the U.S.’s current debt levels, although high, when thinking contextually about the impact of COVID-19 on the economy, the increase in national debt makes sense. The government had to increase spending on federal relief programs to support struggling citizens. Many Americans stopped spending money during the pandemic in order to save their money, and these government relief programs were necessary in order to boost consumer confidence and spending which then helped to restore the economy. Consumer spending was necessary to restart production and create jobs that had been halted because of pandemic concerns. As jobs were restored people could start earning money again and would no longer have to rely on government support to sustain themselves. Ultimately although debt is high, it is appropriately high given the circumstances and has since been on the decline. The incurring debt model exists in the U.S so that the government is capable of supporting citizens whenever citizens require support. Therefore this high debt and subsequent growing economy is a testament to the strength of this model and proves that it is functioning as intended. All in all, individuals should not be concerned about the national debt, and instead recognize its role in boosting the economy rather than believing it to be a burden on the economy.

Cover photo by Alexander Grey on Unsplash